Boost your property sales with

Real Estate CRM

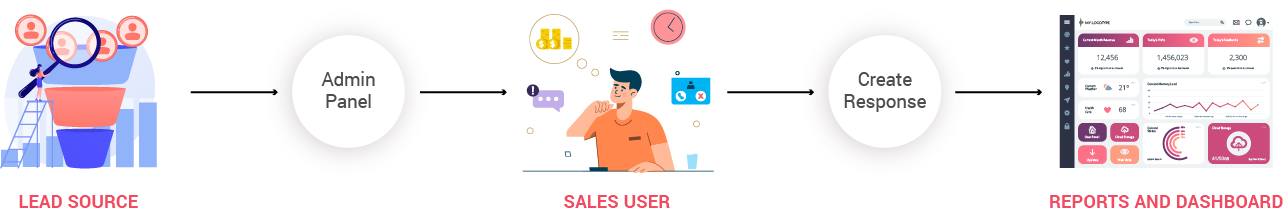

No lead leakage + Ensuring a easy process until a lead becomes a customer

Boost your property sales with

Real Estate CRM

No lead leakage + Ensuring a easy process until a lead becomes a customer

Auto Lead Fetching

API integration from property portals, Google, Facebook for direct fetching of leads. Leads can be automatically assigned and reassigned to sales users.

Notification to Sales User

Sales users can set follow-up reminders for popup notifications. Any new lead assigned or reassigned also gets an instant notification.

SMS with Whatsapp Integration

Sales users can connect to the lead through Whatsapp via CRM application. Our CRM software is WhatsApp integrated, with also having a direct option to connect with leads via call.

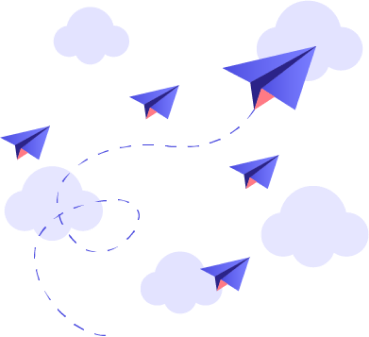

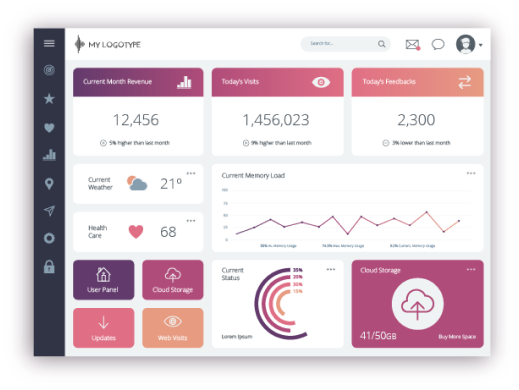

Dashboard & Reports

Get detailed dashboard and management reports. Our Real Estate CRM provides status wise, lead source wise and many more options to regularly check your sales growth.

Real estate Lead Generation

We provide lead generation services primarily through Google, Facebook, and LinkedIn Ads. We do end-to-end management of the campaigns. We also provide other services like social media management, Search Engine Optimization (SEO), and Online Reputation Management (ORM).

Social Media Management

We build social media presence for builders and brokers. This helps them in engaging with the prospective clients on Facebook, Twitter, Linkedin and other platforms.

Auto Lead Fetching

API integration from property portals, Google, Facebook for direct fetching of leads. Leads can be automatically assigned and reassigned to sales users.

Notification to sales user

Sales users can set follow-up reminders for popup notifications. Any new lead assigned or reassigned also gets an instant notification.

SMS with Whatsapp Integration

Sales users can connect to the lead through Whatsapp via CRM application. Our CRM software is WhatsApp integrated, with also having a direct option to connect with leads via call.

DASHBOARD & REPORTS

Get detailed dashboard and management reports. Our Real Estate CRM provides status wise, lead source wise and many more options to regularly check your sales growth.

Lead Generation

We provide lead generation services primarily through Google, Facebook, and LinkedIn Ads. We do end-to-end management of the campaigns. We also provide other services like social media management, Search Engine Optimization (SEO), and Online Reputation Management (ORM).

SOCIAL MEDIA MANAGEMENT

We build social media presence for builders and brokers. This helps them in engaging with the prospective clients on Facebook, Twitter, Linkedin and other platforms.

Whatsapp

Whatsapp